概要

DeFiは、ユニコーンとアニメの寿司が流動性をかけて対決する唯一の場所です。Uniswapは、Ethereum上でトークンをスワップするためのDeFiプロトコルの中でも最も成功したものの1つです。情熱的なビルダーの小さなチームによって作られ、コードをオープンソースにして、誰でもフォークできるようにしました。そして、それはまさにSushiSwapが行ったことなのです!

SushiSwapはUniswapのフォークで、食欲をそそるSUSHIトークンを追加します。プロトコルの管理を保有者に委ね、手数料の一部を保有者にお支払いします。どのようにしてお皿に乗せるのか見てみましょう!

はじめに

Uniswapは、最大級の取引量を誇るDeFiの中核プロトコルの1つとして、その地位を確固たるものにしています。しかし、スマートコントラクトを多用した分散型であるにもかかわらず、開発の方向性に関してユーザーはあまり発言できません。

そんな状況を変えてくれるのが、新規参入のSushiSwapです。ローンチからわずか数日で$10億以上の価値がプロトコルにロックされています – これは、多くの人がこの変化に興味を持っていることを示しています。この記事では、仮想通貨業界に嵐を引き起こしているUniswapのフォークについて説明します。

SushiSwapとは?

SushiSwapは、Uniswapのフォークとしてはじまりました。Uniswapのコードを基盤にしつつ、いくつかの重要な違いを導入しています。– 特に、報酬がSUSHIトークンで分配される点です。SushiSwapの流動性提供者には、プロトコルのネイティブトークンであるSUSHIが報酬として与えられますが、これはガバナンストークンでもあります。Uniswap (UNI) とは異なり、SUSHI保有者は流動性の提供をやめても報酬を得続けることができます。

SUSHIとは?

SUSHIは、ガバナンス権とプロトコルにお支払いされる報酬の一部を保有する権利を有しています。単純化して言えば、SUSHIコミュニティがプロトコルを所有していると言えるでしょう。なぜこれほどまでに関心が高まっているのでしょうか?コミュニティガバナンスは、DeFiの理念に大きく関わっています。トークン配布の有効な方法として流動性マイニング (イールドファーミング) が普及したことで、新しいトークンの発表が盛んに行われるようになりました。

このようなフェアなトークンローンチモデルは、関係者全員が公平に競争できることを目的としており、プレマインがなく、創設者の割り当てもほとんどなく、各ユーザーが提供した資金量に応じて均等に分配されることが多いです。多くの場合、配布されたトークンは、トークン保有者にガバナンス権も付与します。

しかし、トークン保有者はこのガバナンス権を使用して何ができるのでしょうか?SushiSwapでは、誰でもSushiSwap改善案 (SIP) を送信することができ、SUSHI保有者はそれに投票することができます。これらはSushiSwapプロトコルのマイナーな変更でも、メジャーな変更でも構いません。Uniswapのような伝統的なチームではなく、SushiSwapの開発はSUSHIトークン保有者の手に委ねられています。

強力なコミュニティはどんなトークンプロジェクトにとっても強力な資産となりますが、DeFiプロトコルの場合は特にそうです。例えば、MISO (Minimal Initial SushiSwap Offering) は、ガバナンスの提案から生まれたプロダクトです。SushiSwapエコシステムの中で、SUSHIコミュニティの期待に応えられるように調整されたトークンローンチパッドプラットフォームです。MISOでは、個人やコミュニティがSushiSwapプラットフォームを通じて、新しいプロジェクトトークンを立ち上げることができます。

SushiSwapはどのように機能するのでしょうか?

SushiSwapでは、他のDEXプロトコルと同様にERC-20トークンをスワップすることができます。例えば、USDTやBUSDなどのステーブルコインを、Bitcoin (BTC) やEther (ETH) などの仮想通貨に交換することができます。また、寿司をテーマにした様々な機能があり、パッシブインカムを得ることができます。例えば、SUSHIをSushiBarにステークすると、xSUSHIを受け取ることができます。xSUSHIステークでは、保有者はすべての流動性プールからのすべての取引の0.05%の報酬手数料を得ることができます。Shoyuの開始後、xSUSHIにトークンをステークしたSUSHIホルダーは、NFTマーケットプレイスでのNFT取引の2.5%を受け取ることもできます。

BentoBoxもSushiSwapで報酬を得るための機能です。SushiSwapで利用可能なすべてのイールドアーニングツールを利用することができる革新的な保管庫です。つまり、BentoBoxに資産を入金しておくことで、SushiBarへのステークはもちろん、他のユーザーへの貸し出しでも自動的に利息を得ることができるのです。同時に、xSUSHIをお持ちの方は、BentoBoxから発生する決済手数料からも報酬を得ることができます。

Uniswap vs. Sushiswap

仮想通貨がオープンソースの精神に深く根ざしていることは周知の事実です。多くの人は、Bitcoinや増えつつあるパーミッションレスのDeFiプロトコルが、ソフトウェアの形をした新しい種類の公共財として機能すると考えています。これらのプロジェクトは、簡単にコピーされ、小さな変更を加えて再起動されるため、類似製品間の競争につながるのは当然のことだと思います。しかし、それは最終的にはエンドユーザーにとって最良の製品につながるはずだと考えることができます。

現在のDeFi分野の著しい進歩に、Uniswapチームが大きく貢献していることは疑いがありません。しかし、UniswapとSushiswap (もしかしたら、他のフォークプロジェクト) のすべてが繁栄する未来もあるかもしれません。UniswapはAMM分野におけるイノベーションの最前線に残り続けるかもしれませんが、Sushiswapはコミュニティが望む機能によりフォーカスした代替手段となるかもしれません。

とは言うものの、プロトコル間で流動性が分割されるのは理想的ではありません。Uniswapの記事を読んでいたら、AMMはプールの流動性をできる限り高めるとよりうまく機能することをご存じでしょう。DeFiの流動性の多くがたくさんのAMMプロトコル間で分割されたら、エンドユーザーの体験は悪化する可能性があります。

SushiSwapに流動性を提供する方法

この例では、BNB-ETHに流動性を提供しますが、他のペアでも自由にフォローしてください (もちろん、LPトークンがSushiSwapで使用可能であることが条件です)。

3. [バイナンス] をクリックすると、ポップアップが表示されます。パスワードを入力してウォレットのロックを解除するか、ウォレットを持っていない場合は [新しいウォレットを作成] をクリックします。

4. [接続] をクリックします。

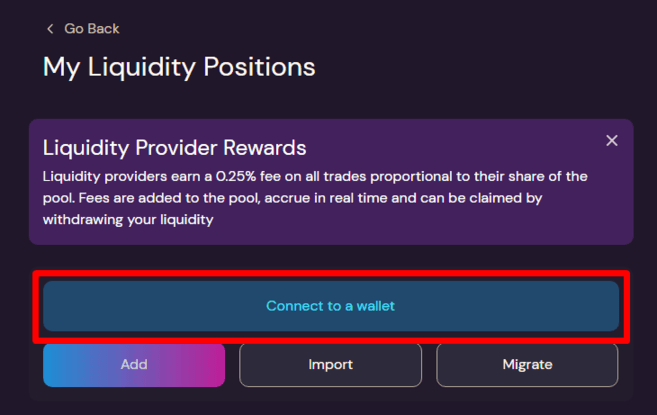

5. SushiSwapプールに戻ります。[追加] をクリックすると流動性が追加されます。

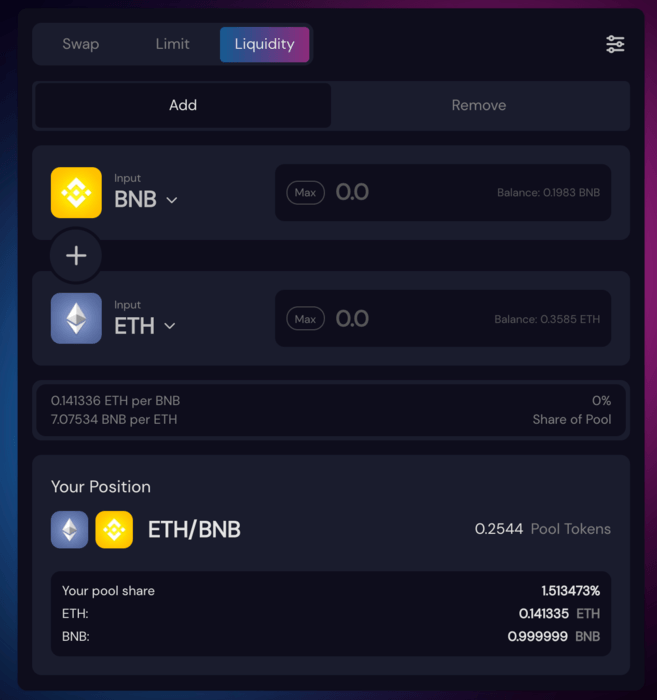

6. [トークン選択] をクリックして、流動性を提供したい仮想通貨のペアを探します。次に、トークンの1つに対する金額を入力します (例: 1BNB)。もう一方のトークンに必要な金額は、システムが自動的に計算してくれます。

また、プールの下部には自分のシェアが表示されています。[ETH承認] をクリックして確定します。

7. この取引の詳細とガス手数料が表示された別のポップアップウィンドウが表示されます。承認する場合は [確認] を、編集する場合は [拒否] をクリックしてください。

8. [流動性追加の確認] をクリックし、[供給確認] をクリックしてBNB-ETHプールに流動性を追加します。

9. ウォレットのポップアップで取引を確認します。

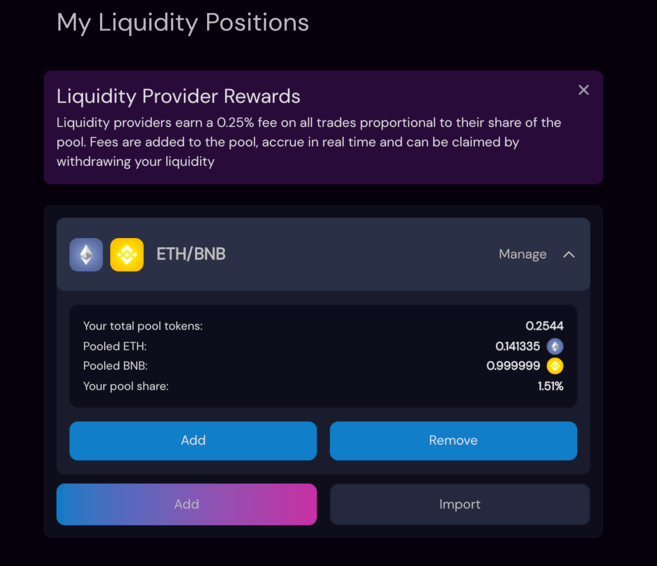

10. BNB-ETHプールへの流動性の追加に成功しました。プールの中での自分の位置とシェアを確認できます。つまり、ユーザーがBNB/ETHを取引すると、取引手数料の報酬を受け取ることができます。

11. ポジションを管理するには、上部のナビゲーションバーから [プール] タブに移動し、ポジションをクリックして流動性を追加または削除します。

このトランザクションにより、あなたのウォレットにはSLPトークンがあることに気付くでしょう。SLPトークンとは、Sushiswap LPトークンのことで、プールに入金したシェアを表しています。SushiSwapではすべての流動性プールがSLPと表示されていますが、実際には異なるプールを表しています。

BinanceでSUSHIを売買する方法

1. バイナンスアカウントにログインし、上部ナビゲーションバーの [トレード] をクリックして、クラシックまたはアドバンスの取引ページを選択します。

SushiSwapのリスク

まとめ

SushiSwapは、すでに成功しているDeFiプロトコルの競争優位性に挑戦するエキサイティングな実験です – Uniswap。Uniswapのフォークにもかかわらず、SushiSwapはプロトコルに新しい機能を追加しており、その主な違いはコミュニティガバナンスです。2021年には、SushiSwapがNFTプラットフォームを導入し、繁栄するNFT市場を利用しようとしています。

SushiSwapは、ローンチ以来、ロックされた総額で他の多くのDeFiプロジェクトを瞬く間に追い抜き、今後も人気と牽引力を高めていくことができました。SushiSwapがどれだけ最終的に成功したとしても、DeFi分野においてはいかなる商品もサービスも圧倒的な優位性というものを持っていないことがわかります。