TL;DR

Market sentiment considers investors' thoughts, feelings, and moods regarding an asset. These feelings don't always reflect an asset or project's fundamentals but can significantly affect the price.

Market sentiment analysis is a form of research that uses this information to try and predict price movements. By tracking the market dynamics with its participants' overall attitudes, you can understand the amount of hype or fear surrounding a specific cryptocurrency.

Introduction

Just like other assets, the price of a cryptocurrency is directly related to market supply and demand. These market forces can change for several reasons, including public opinion, the press, and social media.

Many traders analyze the market's sentiment to predict the short and mid-term potential of a crypto asset. Along with the technical and fundamental analysis, investigating the crypto market sentiment can be a valuable addition to a trader's toolkit.

What is market sentiment?

Market sentiment is the collective attitude of traders and investors towards a financial asset or market. The concept exists in all financial markets, including cryptocurrencies. Market sentiment does have the power to influence market cycles.

Still, favorable market sentiment doesn't always lead to positive market conditions. Sometimes, strong positive sentiment (it's going to the moon!) may come before a market correction or even a bearish market.

Besides providing insights into market demand, traders can analyze these sentiments to predict potentially profitable trends. Market sentiment doesn't always consider a project's fundamentals, but they might be linked sometimes.

Let’s take Dogecoin as an example. A lot of Dogecoin's demand in its bull run likely came from social media hype (which led to positive market sentiment). Many traders and investors bought Dogecoin without considering the project's tokenomics or goals, but only because of the current market sentiment. Even a single tweet from a figure like Elon Musk is enough sometimes to cause positive or negative market sentiment.

Why is market sentiment analysis important?

Market sentiment analysis is an essential part of many trading strategies. Like technical or fundamental analysis, it's usually a good idea to make decisions using a mixture of all the information available.

For instance, market sentiment analysis can help you investigate whether FOMO is justified or simply a result of herd mentality. Overall, combining technical and fundamental analysis with market sentiment studies allows you to:

Get a better idea of short and mid-term price action.

Develop better control of your emotional state.

Discover potentially profitable opportunities.

How to perform market sentiment analysis

To understand the market's sentiment, you'll need to collect the market participants' views, ideas, and opinions. Again, while it can be helpful, you should not rely solely on market sentiment analysis. You could rather use the information collected in combination with your existing knowledge and experience before drawing actionable conclusions.

To get a basic feel, you might consider investigating the relevant social media pages and channels to understand what the community and investors are feeling about that specific project. You may also join official forums, Discord servers, or Telegram groups to talk directly with the project’s team and community members. But be careful! There are many scammers in those groups. Don’t trust random people, and make sure to do your own research before taking risks.

Social channels are just the first step. You can use many methods to get a broad overview of market sentiment. On top of monitoring social channels (particularly Twitter, given its popularity among cryptocurrency fans), you might consider the following:

1. Track social mentions with data collection software tools.

2. Stay up to date with the latest industry news through media portals and blogs. Binance Blog, Binance News, Bitcoin Magazine, CoinDesk, and CoinTelegraph are some examples.

3. Set alerts or track large transactions made by whales. These movements are regularly tracked by some crypto investors and sometimes might have an impact on market sentiment. You can find free whale alert bots on Telegram and Twitter.

4. Check market sentiment indicators and pricing signals on CoinMarketCap. These indexes analyze a range of different sources and provide easy summaries of current market sentiment.

5. Measure the level of hype surrounding a cryptocurrency with Google Trends. For example, a large search volume for “How to sell crypto,” could suggest that the market sentiment is negative.

Market sentiment indicators

Investors can look at market sentiment indicators to get an idea of the bullish or bearish feel of a market or asset. Indicators represent these feelings either graphically or with some kind of scale. These tools can make up a part of your sentiment analysis kit but shouldn’t be relied upon solely. It’s best practice to use multiple indicators to get a more balanced view of the market.

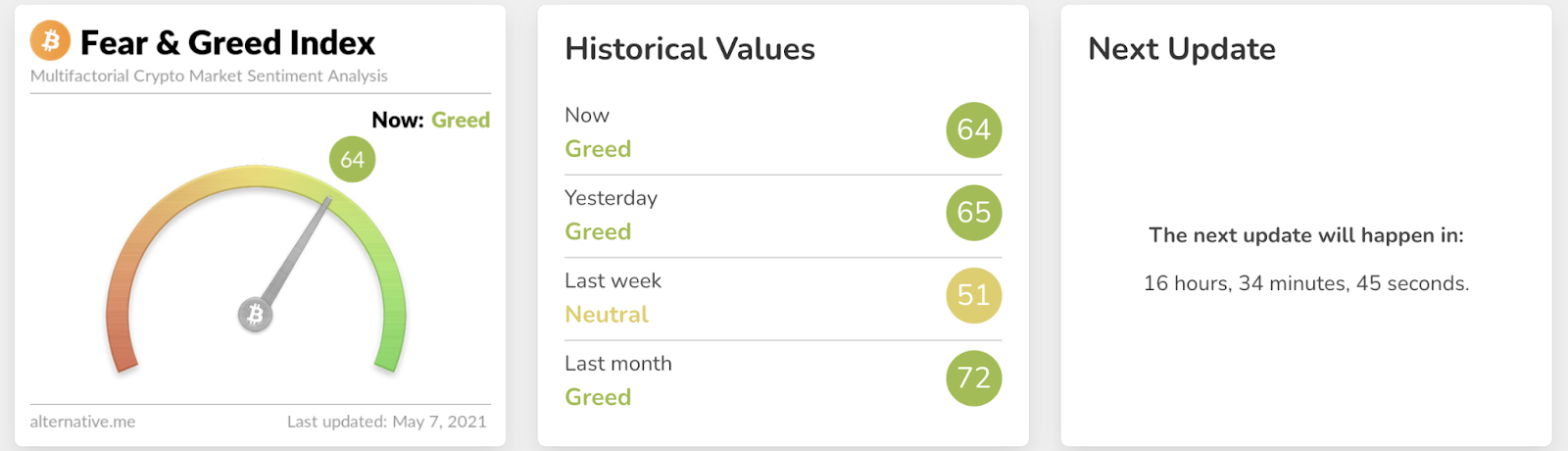

Most market sentiment indicators are focused on Bitcoin (BTC), but you can also find Ethereum (ETH) sentiment indexes. The Bitcoin Crypto Fear & Greed Index is perhaps the most known indicator of crypto market sentiment. The index shows Bitcoin market fear or greed on a scale of zero to 100 by analyzing five different information sources: volatility, market volume, social media, dominance, and trends.

The Bull & Bear Index by Augmento is a different sentiment indicator concentrating on social media. An artificial intelligence (AI) software analyzes 93 sentiments and topics using conversations on Twitter, Reddit, and Bitcointalk. The creators also backtest their indicator’s methodology with the year’s worth of data available. Zero is extremely bearish on the scale and one extremely bullish.

Putting it all together

Analyzing social media channels, on-chain metrics, and other crypto indicators can provide insights into a coin or project's sentiment. With a better understanding of the market's current attitudes, you are more likely to make better trading or investment decisions.

To help maximize the effectiveness of sentiment analysis, it’s usually best to combine it with:

Technical analysis – might help you make better predictions when it comes to short-term price action.

Fundamental analysis – to determine whether controversial information is justified or to evaluate a coin’s long-term potential.

Closing thoughts

While many traders use market sentiment analysis in investment markets, it can be particularly useful in the cryptocurrency market. Because the blockchain industry and crypto markets are still relatively small, public perceptions and sentiment can cause volatile price fluctuations.

By utilizing the methods discussed, you can begin to understand market sentiment and (hopefully) make better investment choices. Again, if you want to get started with market sentiment analysis, you may consider:

Tracking social media channels and the emotions surrounding a project.

Staying up to date with the latest industry news and upcoming events.

Using indicators that help you get a better idea of the public interest on a particular coin.

Market sentiment analysis tends to offer better results with more practice and experience, but it might not work in some cases. Make sure to do your due diligence before trading or investing because every decision involves a certain amount of risk.