TL;DR

Terra is a blockchain network built using Cosmos SDK specializing in stablecoin creation. Rather than use fiat or over-collateralized crypto as reserves, each Terra stablecoin is convertible into the network's native token, LUNA.

LUNA allows holders to pay network fees, participate in governance, stake in the Tendermint Delegated Proof of Stake consensus mechanism, and peg stablecoins.

To peg a stablecoin like TerraUSD (UST), a USD value of LUNA is convertible at a 1:1 ratio with UST tokens. If UST's price is, for example, at $0.98, arbitrageurs swap 1 UST for $1 of USD and make 2 cents. This mechanism increases UST demand and also reduces its supply as the UST is burned. The stablecoin then returns to its peg.

When UST is above $1, say at $1.02, arbitrageurs convert $1 of LUNA into 1 UST and make 2 cents. The supply of UST increases, and demand for UST also decreases, bringing the price back to peg.

Apart from reducing stablecoin volatility, validators and delegators stake LUNA for rewards. These two actors play an essential part in keeping the network secure and confirming transactions.

You can purchase LUNA via Binance and then store it, stake it, and participate in governance with Terra Station, the official wallet and dashboard for the Terra blockchain network.

Introduction

For stablecoin lovers, there are now multiple options to pick from when choosing where to invest. And it's not all fiat-backed stablecoins either. There's a wide variety of methods and networks experimenting with ways of keeping stablecoins pegged. Terra is one such project developing a unique approach to stablecoins and the tools developers can use to create their own pegged tokens.

What does Terra do?

The project has proved popular in the Asian markets for e-commerce and has a large userbase in South Korea. For example, taxi users in Mongolia can pay some drivers in the stablecoin Terra MNT pegged to the Mongolian tugrik. Tokens minted on the platform are known as Terra currencies and exist alongside the network's native LUNA token for governance and utility. Terra and LUNA have a complementary relationship.

Terra already has stablecoins pegged to the US Dollar, South Korean Won, and Euro, among others. Within a short time, the project has seen wide popularity with the stablecoins minted on the platform. TerraUSD has, as of writing, already made it to the fourth-largest stablecoin by market cap.

What are Terra stablecoins?

Terra's stablecoins, however, use algorithmic methods to control their supply and maintain the peg. Each stablecoin is, in effect, backed up and exchangeable for the governance and utility token LUNA. Terra acts as a counterparty for anyone looking to swap their stablecoins for LUNA and vice versa, which affects the two tokens' supplies.

How does TerraUSD (UST) work?

Imagine you want to mint $100 of TerraUSD (UST), which is equal to 100 UST at the peg. To mint the UST, you'll need to convert an equivalent monetary amount of LUNA tokens. Terra will then burn the LUNA tokens you supply. So, if the price of LUNA is $50 per coin, the algorithm would require you to burn 2 LUNA to mint 100 UST. Previously, Terra only burned a portion of the tokens provided, but with the introduction of the Columbus-5 update, 100% is burned.

You can also mint LUNA with Terra stablecoins. Minting $100 of LUNA (2 LUNA) would require burning 100 UST. Even if the market price of UST isn't $1 per token, the conversion rate for minting treats 1 UST as equal to $1. This exchange mechanism is what gives UST its price stability.

Let's look at an example to see exactly how the algorithm works to try and keep the price stable:

1. The price of 1 UST falls to $0.98, 2 cents lower than its intended pegged value. However, for all conversions between Terra stablecoins and LUNA, 1 UST is treated as being worth $1.

3. The arbitrageur can either keep their $100 of LUNA or convert it to fiat and cash out their profit. While $2 doesn't sound like much, bigger profits can be made on a larger scale. This difference between the price of minting the tokens and their value is known as seigniorage

But how does this end up stabilizing the price at $1? First, the increased purchasing of UST by arbitrageurs increases UST's price. Additionally, Terra burns the UST during the exchange to LUNA, reducing its supply and contributing to increasing UST's price. Once 1 UST reaches $1, the arbitrage opportunity closes.

The same process works in reverse when the price of UST is above $1. Let’s see another example.

1. The price of 1 UST rises $1.02, which also provides arbitrageurs a way to make a profit.

2. Arbitrageurs purchase $100 of LUNA and convert it to $102 worth of UST on the Terra Station Market Module. Terra burns the LUNA and mints UST in the process, increasing supply.

3. The arbitrageurs can then sell that UST on the open market to capture the profit. This selling pressure on UST brings the price back to peg.

What's LUNA?

LUNA is Terra's cryptocurrency that plays four different roles in the Terra protocol:

1. A method to pay transaction fees in its gas system (utility token).

3. A mechanism to absorb demand fluctuations for stablecoins minted on Terra to maintain price pegs.

LUNA has a maximum target supply of one billion tokens. If the network exceeds one billion LUNA, Terra will burn LUNA until its supply returns to the equilibrium level.

Staking rewards from LUNA

How does Terra's Delegated Proof of Stake consensus mechanism work?

As of October 2021, Terra uses a group of up to 130 validators to process transactions. Users (or delegators) stake their tokens behind a validator. In turn, the validator secures the network by processing transactions similar to the work of a miner on Bitcoin. A delegator will stake their LUNA tokens behind a validator they believe will effectively and honestly process network transactions. Each validator can also set a custom percentage of the rewards they will distribute to their delegators.

Validators must also lock up a set amount of LUNA for at least 21 days. This process is known as bonding. Delegators also experience a 21-day lockup period and risk losing their stake if the validator is a bad actor.

For example, the validator may process double-spent transactions or include false ones. In this case, the validator can have their rewards slashed or even lose their initial stake (bond). “Terra taxes” on transactions and airdrops provide the rewards given to delegators and validators. Each delegator's share will depend on the amount they stake and the validator's commission rate.

What is Terra Station?

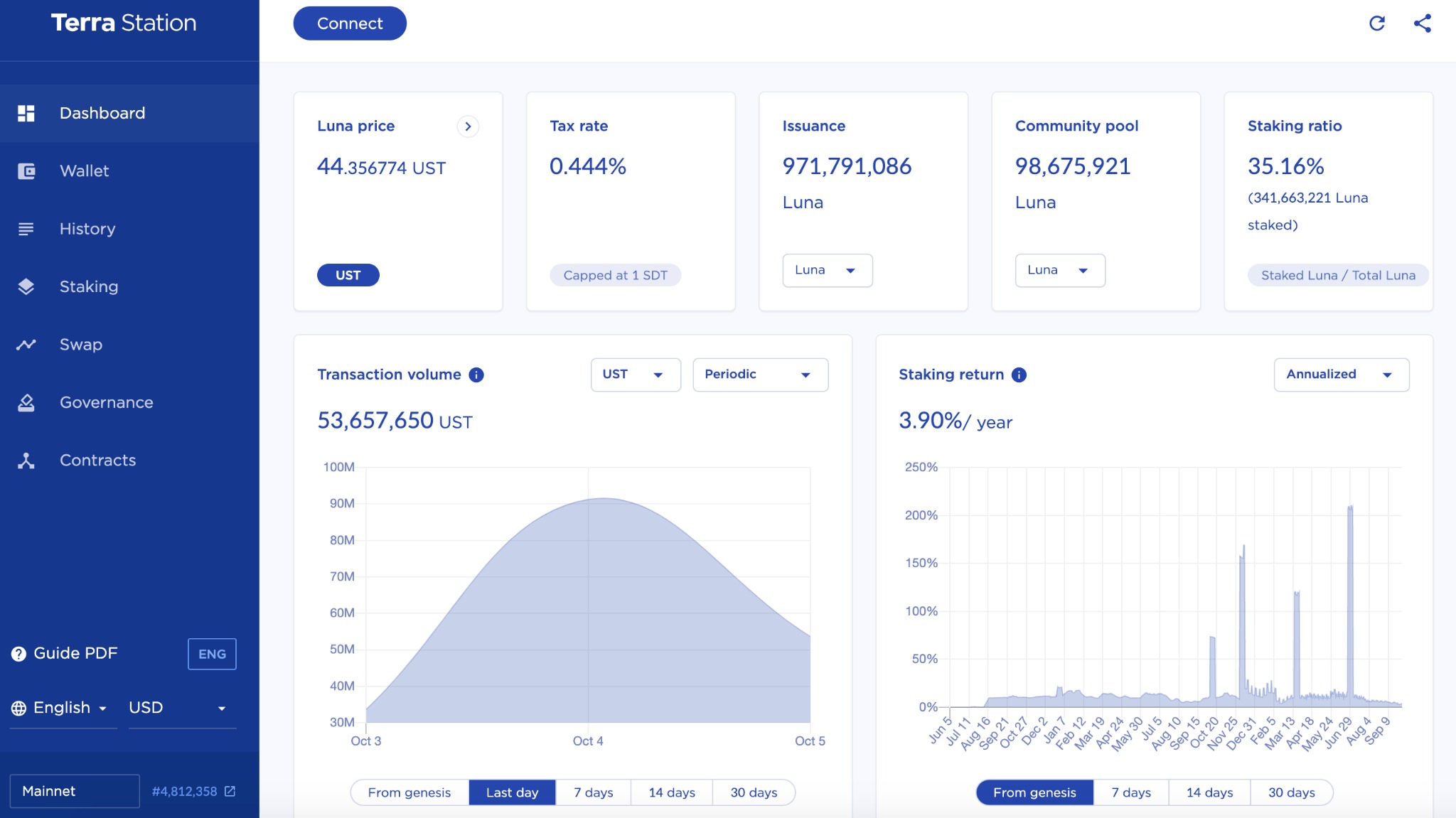

1. The Terra Station dashboard displays a range of on-chain data, including transaction volume, staking returns, and the number of active accounts.

3. The governance portal allows you to create new proposals and take them to the voting stage by depositing 512 LUNA. Other users may deposit the 512 LUNA for you instead if you don't have the funds. When a new proposal is created, other LUNA holders can stake their tokens to cast their votes.

4. The staking tokens section lets you delegate, check your rewards, bond LUNA as a validator, and take part in every stage of the DPoS consensus mechanism.

What is Anchor Protocol (ANC)?

- You can stake ANC-UST Terraswap LP tokens to receive ANC rewards.

- You can stake ANC by itself.

- You can borrow stablecoins through Anchor Protocol.

You can also use ANC as part of Anchor Protocol’s governance mechanism for creating and voting on proposals. You can buy ANC on Binance using the same method outlined for LUNA above.

Closing thoughts

In the future, there will be a lot of opportunities for Terra to take advantage of its cross-chain compatibility with other Cosmos SDK blockchains. As the stablecoin topic is important globally regarding regulation and mainstream adoption in payment systems, there's room for Terra to grow and improve its user base outside of Asia.