What is cryptoeconomics?

In simple terms, cryptoeconomics provides a way to coordinate the behavior of network participants by combining cryptography with economics.

More specifically, cryptoeconomics is an area of computer science that attempts to solve participant coordination problems in digital ecosystems through cryptography and economic incentives.

Rather than being a subset of traditional economics, cryptoeconomics is a mix of game theory, mechanism design, mathematics, and other methodologies from the field of economics. The main goal is to understand how to fund, design, develop, and facilitate the operations of decentralized networks.

This article will dive into the origins of cryptoeconomics and its role in the design of Bitcoin and other decentralized networks.

What problem does cryptoeconomics solve?

This synergy of cryptographic protocols with economic incentives enables an entirely new ecosystem of decentralized networks that are resilient and secure.

The role of cryptoeconomics in Bitcoin mining

The goal of Bitcoin is to create a value transfer network that accurately verifies transfers of value, and that is immutable and censorship-resistant.

The process of mining involves solving a difficult mathematical problem based on a cryptographic hash algorithm. In this context, hashes are used to tie each block to the next block, essentially creating a timestamped record of approved transactions called the blockchain.

These technological rules relating to mining are aligned with the security requirements of the Bitcoin network, including preventing malicious actors from taking control.

How does cryptoeconomics enhance Bitcoin’s security?

Cryptoeconomics is one of the reasons Bitcoin has been successful. Satoshi Nakamoto implemented assumptions to encourage certain incentives for the different participant classes of the network. The system’s security guarantees depend a lot on the effectiveness of these assumptions about how network participants react to certain economic incentives.

Based on cryptoeconomic assumptions, the symbiotic relationship between miners and the Bitcoin network provides confidence. However, this is not a guarantee that the system will persist in the future.

The cryptoeconomic circle

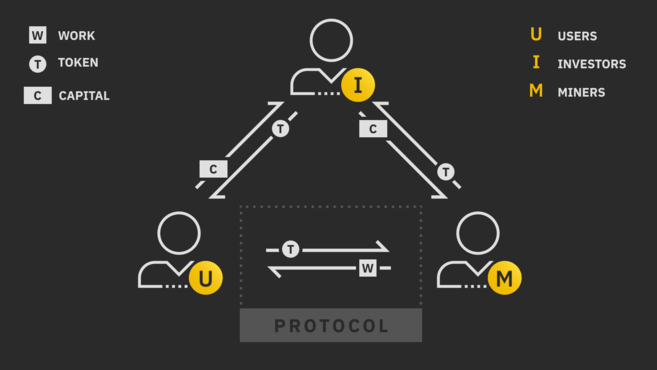

The cryptoeconomic circle is a holistic model of cryptoeconomics. It was published by Joel Monegro and illustrates abstract flows of value through different participant classes in such a peer-to-peer economy.

The model represents a three-sided market between miners (the supply side), users (the demand side), and investors (the capital side). Each group exchanges value between one another using a scarce cryptoeconomic resource (a token).

In the miner-user relationship in the circle, miners are compensated for their work through tokens used by the users. The network’s consensus protocol standardizes this process, while the cryptoeconomic model controls when and how miners get paid.

Creating a network architecture that is sustained by a distributed supply side (miners) is desirable as long as the benefits outweigh the disadvantages. The benefits often include censorship resistance, borderless transactions, and higher reliability. But, decentralized systems tend to have lower performance when compared to centralized models.

Traders create liquidity for the token so miners can sell their mined tokens and cover operational costs, while holders capitalize the network for growth by supporting token prices. The miner-trader relationship works with a direct flow of value, while the miner-holder relationship works with an indirect flow of value.

This simply means that all the participants in such an economy depend on each other to reach their economic goals. Such a design creates a robust and secure network. Compliance with the incentivized ruleset is more beneficial to the individual participant than malicious activity - which in turn makes the network more resilient.

Closing thoughts

Even though a relatively new concept that emerged with the birth of Bitcoin, cryptoeconomics is a significant building block to consider when designing decentralized networks.

Isolating the different roles in cryptoeconomic models helps to analyze costs, incentives, and value flows for each participant group. It can also help to think about relative power and identify potential points of centralization, which is important to design more balanced governance and token distribution models.

The field of cryptoeconomics and the usage of cryptoeconomic models can be highly beneficial during the development of future networks. By studying cryptoeconomic models that were already tried and tested in live environments, future networks can be designed to be more efficient and sustainable, resulting in a more robust ecosystem of decentralized economies.