TL;DR

2021 has been a real breakthrough year for crypto use cases. Technologies like NFTs and the metaverse have made mainstream news, and blockchain adoption has increased. When it comes to regulation, the year has seen stories of crackdowns and embrace.

El Salvador adopted Bitcoin as a legal tender. In the US, the SEC allowed for the first Bitcoin ETFs to be listed on the Chicago Mercantile Exchange. Canada also launched their own Bitcoin ETFs, an essential part of institutional investor adoption.

NFTs have seen explosive success this year with record-breaking sales and exposure. What was a small crypto niche in previous years is now a widely-discussed topic. Binance launched its own NFT platform to meet demand, and Fortune 500 companies are increasingly using and investing in NFTs.

NFTs also have a role in the metaverse, another of 2021's hottest topics. Tech giants and small developers alike are building a connected, 3D world with crypto powering its economy. The trend also relates to Web3, the concept of decentralization fueling our future interactions on the internet. Large capital investment firms showed their support this year for blockchain implementation in our online interactions, data, privacy, and finances.

Binance Fan Tokens have also taken off with sports clubs like FC Porto and S.S. Lazio. Most of the 2021 sales have been oversubscribed, with users enjoying new fan benefits based on the blockchain.

Finishing off the year, Bitcoin reached a new ATH (all-time high) of almost $70,000 in November.

Introduction

There's no such thing as a boring year when it comes to the cryptocurrency world. From NFTs capturing creators' imaginations to soaring new all-time highs for Bitcoin, 2021 has had it all. So while it seems like everyone is preparing to jump into the blockchain-powered metaverse, let's not forget everything else that has taken place this year.

Cryptocurrency regulation

Over the years, cryptocurrencies have gradually become more regulated. But in 2021, not every government had the same goal in mind. Some, like El Salvador, looked to embrace the technology and benefit from integrating it into everyone's daily lives. Others have tightened the taxation and treated crypto as something to be tightly controlled.

El Salvador

El Salvador made headlines worldwide on June 5, 2021, announcing that Bitcoin would become legal tender within the country. From September 7, 2021, all businesses were required to accept BTC as payment for goods and services. This fact makes El Salvador the first country to officially adopt Bitcoin as a payment method. The government gave away $30 of Bitcoin in celebration to every citizen who downloaded the government's digital crypto wallet.

El Salvador points to Bitcoin as a way to reduce the fees its population pays in remittances, a large area of the economy as families receive money from abroad. Most Salvadorans also don't have access to financial services, and blockchain is a possible solution in helping the unbanked. Globally, some external commentators have seen the move as a way for El Salvador to rebrand itself. The country had a problematic reputation tied to criminal gangs and the underground economy.

The United States

Apart from the launch of Bitcoin ETFs (exchange-traded funds), there have been regular updates regarding the SEC's areas of interest. Notably, stablecoins and Decentralized Finance (DeFi) are under discussion, as they present more regulatory challenges than cryptocurrencies like Bitcoin. We will more than likely see big announcements coming next year in the regulation of these two areas.

Bitcoin ETFs

The creation and regulation of Bitcoin ETFs have been seen by some as a key to introducing crypto to traditional investors. Unlike private investors, highly-regulated institutions can't just open a wallet and start trading crypto. 2021 saw the release of Bitcoin ETFs in Canada and the US after a long discussion with regulators. An ETF allows someone to expose their portfolio to Bitcoin without holding the asset themself. Many Bitcoin ETFs, such as the US's BITO, actually use BTC futures as the ETF's underlying asset.

The SEC favored futures ETFs tied to the Chicago Mercantile Exchange's (CME) already-existing Bitcoin futures. These derivatives are highly regulated within the USA, allowing the ETF to piggyback off them. There are now three US-based ETF options, with the possibility of physically-backed funds coming at some future point.

Non-fungible tokens (NFTs)

While NFTs aren't anything new in the blockchain world, they have managed to have a breakout year with the general public. In March, we had the world's most expensive NFT sale of Beeple's "Everyday: The First 5,000 Days" for $69 million. In addition, NFT games have also seen a significant increase in popularity.

Establishing original authenticity can be challenging, but blockchain allowed for the creation of a verifiable method for digital rarity. It solved the "copy-paste" problem we have with proving the authenticity of digital assets and files. With such a vast amount of use cases, developers are experimenting with NFTs across industries, and we can expect some big news in 2022 and beyond.

The metaverse

After a massive start with NFTs, 2021 has ended with another huge trend: the metaverse. By far, the biggest reason for the metaverse's popularity has been the interest from big tech. On October 28, Facebook changed its name to Meta and outlined its vision of a 3D virtual universe connecting multiple aspects of our lives. You can see this increase in search popularity reflected in Google Trends.

Meta isn't the only company to think of this either. The metaverse concept has been around for years, and many crypto projects have created their own metaverse worlds. Decentraland, for example, lets you explore a 3D world, own virtual land, and even make a living with its play-to-earn mechanisms. Blockchain games like Axie Infinity also allow you to combine gaming with a method to earn a steady income. So while we don't have one united metaverse yet, the pieces are coming together.

Web3

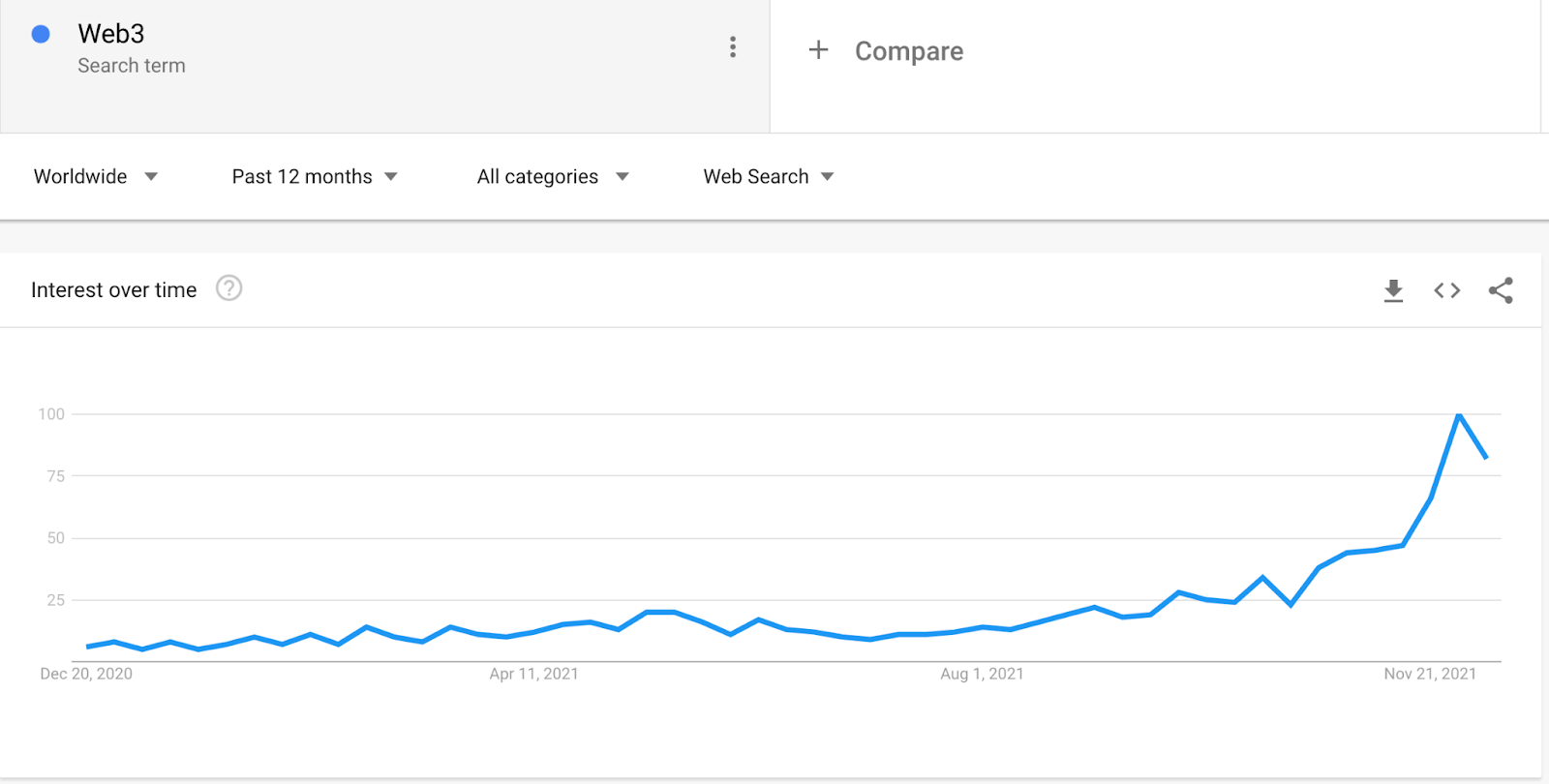

Web3 is the concept of a new version of the internet based on public blockchains like Ethereum or BNB Smart Chain. The term was initially created in 2014 by Gavin Wood, co-founder of Ethereum and founder of Polkadot. However, it hasn't been until this year that the concept has started to gain traction, especially with the endorsement of large investment firms like Andreessen Horowitz around October 2021.

Web3 aims to use decentralization as a base for new developments for the internet. But how is this different from the metaverse? Well, the metaverse wants to create a 3D, connected world. Web3 concentrates more on how we're using the internet in its current form to control our identity, personal information, and interactions. Websites and applications will also use big data in meaningful ways to enhance the online experience.

NFTs, DAOs (decentralized autonomous organizations), and DeFi all look to become essential parts of how we use the internet, similar to how emails, PayPal, and 2FA (two-factor authentication) were key to Web 1.0 and Web 2.0.

Binance Fan Tokens

On October 21, 2021, Binance helped launch the first Binance Fan Token through its Launchpad with S.S. Lazio. Holders gained unique privileges, such as the right to enter fan votes on team decisions, the chance to earn NFTs, and new ways to interact with their favorite teams.

But while 2021 has been a big year for Binance Fan Tokens, this isn't where the story starts. Fan tokens have been around since late 2019 with Juventus' JUV token launch. These tokens allow holders to interact with their favorite teams and claim unique fan token benefits.

Through Binance Launchpool, users stake BNB and receive a portion of the Binance Fan Tokens on offer. So far, the sales have proved hugely successful. For example, LAZIO had 225,583 participants commit 8,110,631.97 BNB, meaning the sale was oversubscribed by a multiplier of 1,005x.

Cryptocurrency market and Bitcoin all-time highs

After a strong rally in 2020, Bitcoin has once again beaten the previous year’s all-time high with three peaks in 2021. Let's take a look at the chart.

Point 1 shows the end of 2020's rally continuing into January 2021 with a peak of roughly $41,000. After some fear of entering into a bear market followed by a correction, Bitcoin continued moving up and reached $63,000 halfway through April (Point 2). In June, the market had bad news for crypto, leading to around half of all Bitcoin mining power going offline in a matter of days.

Nevertheless, Bitcoin has rallied back since reaching its new ATH of around $69,000 in November. Let's see the new ATHs for some of the other largest market cap cryptocurrencies as well.

Closing thoughts

A running theme of 2021 has been the adoption of novel blockchain use cases like NFTs and the metaverse. By now, the world is getting more familiar with cryptocurrencies like Bitcoin, the mining industry, and cryptocurrency trading. This has made 2021 particularly exciting, as the world's newspapers no longer only report on rising prices when it comes to crypto. Many of the trends we've discussed have set themselves up well for 2022, giving us a lot to be excited about over the upcoming 12 months.