Key Takeaways

Kyber Network is a decentralized protocol built on Ethereum. It’s deployed on multiple Ethereum Virtual Machine (EVM) compatible chains, such as Polygon, BNB Chain, and Avalanche.

Founded by Loi Luu and Victor Tran, Kyber Network is a liquidity hub that aims to make DeFi trading more efficient and cost-effective. Kyber Network’s main product is KyberSwap, a decentralized exchange (DEX) that allows users to trade tokens and earn rewards by providing liquidity.

The protocol is governed by KyberDAO, and proposals are voted on by holders of the Kyber Network’s native token, KNC.

What is KyberSwap?

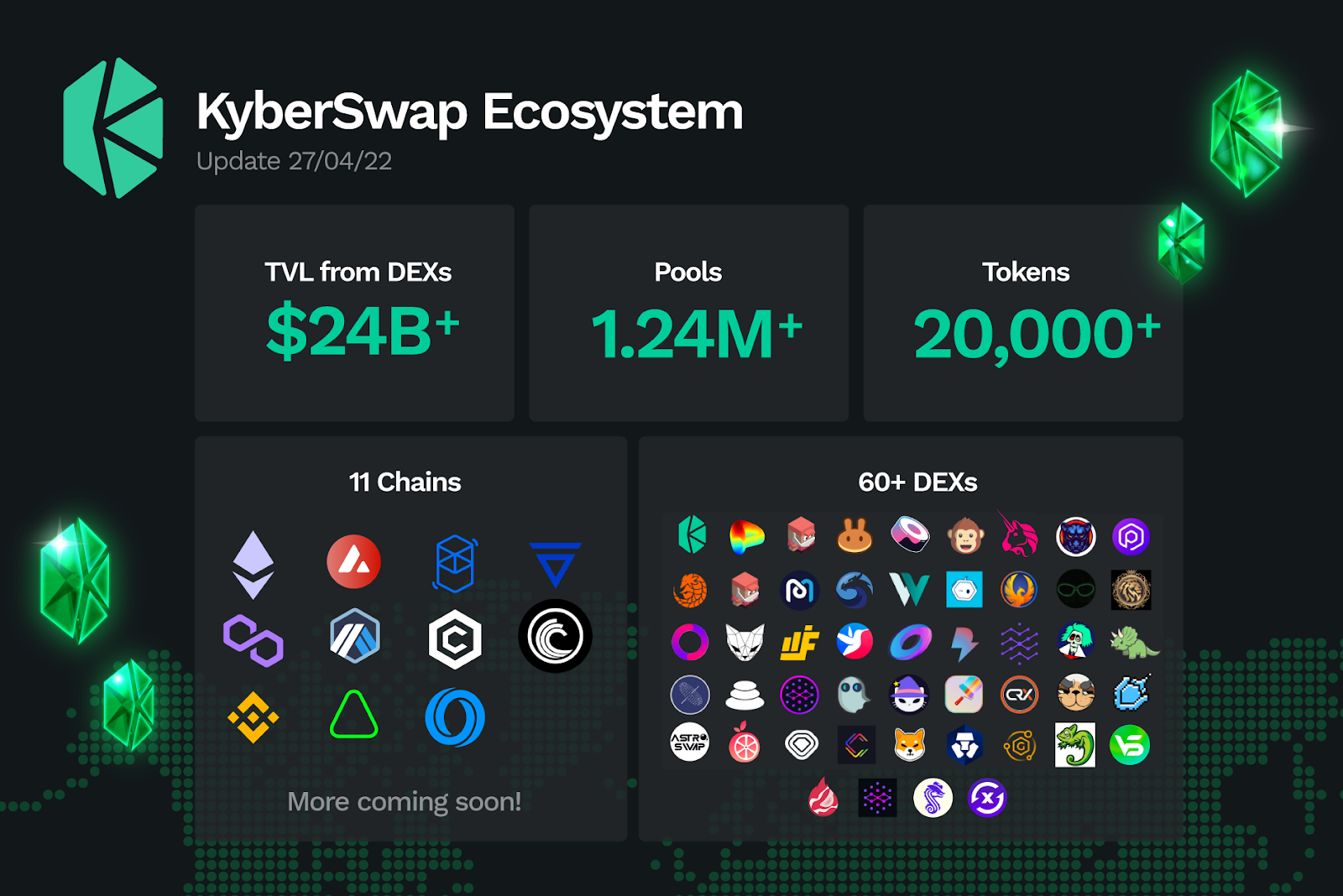

KyberSwap is the flagship product powered by the Kyber Network. Built on Ethereum, KyberSwap is a multi-chain decentralized exchange (DEX) that allows users to conduct transactions on any of its 12 supported networks, including Ethereum, Polygon, BNB, Avalanche, and Optimism.

KyberSwap is also an aggregator, meaning it sources liquidity not only from its own pools but also from over 67 DEXs across its supported networks. Similar to other DEXs, KyberSwap is a trustless trading platform, which means users have complete control over their orders and funds. KyberSwap aims to solve the liquidity challenges that many DeFi traders encounter every day, while also providing adequate rewards for liquidity providers (LPs).

KyberSwap enables users to swap, earn and seamlessly participate in DeFi in each of the supported chains. KyberSwap is a decentralized and permissionless trading platform. This means users have complete control over their orders and funds.

KyberSwap aims to solve the daily liquidity challenges that many DeFi Traders encounter while also maximizing rewards for liquidity providers with superior capital-efficient pools.

How does KyberSwap work?

KyberSwap is split into two main protocols: Classic and Elastic.

KyberSwap Classic’s Dynamic Market Maker (DMM) protocol is a modified version of the traditional Automated Market Maker (AMM) model used by UniSwap and other DEXs. It is DeFi’s first market maker protocol that dynamically adjusts LP fees based on market conditions. When the market is too volatile, fees increase to better reflect the risks involved in each trade. When the market is stable and volatility drops, fees decrease. The DMM automatically recalculates fees by analyzing on-chain volume data for each liquidity pool.

KyberSwap Classic’s second feature is a “programmable price curve” called Amplification (AMP). This allows a liquidity pool to mimic higher levels of liquidity without requiring more tokens. LPs can set their own AMP according to the type of token pair in the pool. Pairs with lower deviations, like stablecoins, will have higher AMP. On the other hand, more volatile pairs will have lower AMP. Liquidity pools with AMP equal to 1 are pools that still work according to the dynamic fee model but with no amplification.

KyberSwap’s newest protocol, dubbed KyberSwap Elastic, is a tick-based AMM with concentrated liquidity. Users can add liquidity to a specific price range of their choice and receive an NFT that represents their liquidity position and their share of the pool.

With concentrated liquidity, LPs can specify the price range to which they want to add liquidity. The price range selected represents the degree to which an LP thinks the current price will fluctuate in the future. The liquidity provided will then be evenly distributed over this price range. LPs get a fee for any swap to be processed at a specific price ( in other words, at a specific active tick) in the selected range, proportional to the liquidity provided at that price (or at that active tick).

A full price range allows tokens to be traded at any price but may come with lower fees than a concentrated price range, due to the liquidity allocation on inactive price ticks.

KyberSwap Elastic also auto-compounds fees for LPs using a Reinvestment Curve. Not only does this make things more convenient for LPs as they don’t have to add liquidity manually back into the pool, but separately compounding fees allows LPs to earn more as fees are accumulated on top of the compounded fees.

In addition, KyberSwap Elastic comes with multiple fee tiers and JIT (Just In Time) Protection to give LPs the flexibility and tools to tailor earning strategies without compromising on security.

LPs can also earn rewards through KyberSwap’s liquidity mining farms. This is where KyberSwap works with blockchain foundations and projects to provide offers for lLPs.

Beyond liquidity services, KyberSwap has features and pro trader tools designed to help DeFi traders, such as Discover, Dynamic Trade Routing, and Pro Live Chart. Discover is an intuitive DeFi tool that helps users find potentially trending tokens using a combination of on-chain data, trading volume, and technical indicators. Dynamic Trade Routing scans different DEXs and splits trades to find the most suitable trading route for any token swap on supported networks.

Pro Live Chart, on the other hand, is integrated with TradingView to help traders map and conduct a complete technical analysis.

What makes KyberSwap unique?

As mentioned above, KyberSwap Classic uses two different features — DMM and Amplification — to ensure healthy liquidity, while KyberSwap Elastic brings concentrated liquidity, auto-compoundability, multiple fee tiers, and JIT protection to help liquidity providers maximize their earnings safely and securely.

Liquidity ensures that traders can easily buy and sell assets without big price changes. Low liquidity leads to slippage and impermanent loss. The more volatile an asset, the more likely its price changes will negatively affect traders.

Slippage is when a trade is executed at a lower or higher price than desired due to low liquidity (thin order books).

Impermanent loss can be defined as a price decrease experienced by a crypto asset after being placed in a liquidity pool.

Liquidity can be considered the ease with which traders are able to buy or sell an asset: easy trades favor price stability, and a higher number of participants makes it harder for single entities to affect the market.

What is the Kyber Network Crystal (KNC) token?

Kyber Network Crystal (KNC) is KyberSwap’s native token that fuels the Kyber Network ecosystem. Working on a proof-of-stake (PoS) consensus mechanism, KNC holders can participate in the DAO and vote on all governance proposals related to the future of the network by staking their KNC assets or delegating their vote to a third-party platform.

KNC holders can also stake their tokens in eligible Rainmaker farming pools for liquidity-mining rewards. For other activities such as Trading Contest, Gleam Giveaway, and AMAs, participants are also rewarded with KNC tokens.

Closing Thoughts

Kyber Network is a liquidity hub that powers KyberSwap, a DEX built on Ethereum. It’s a hub for decentralized services and a place where DeFi enthusiasts can build, exchange, and improve the crypto space. KyberSwap is focused on improving the experience for LPs and traders in the DeFi space.

Disclaimer: Cryptocurrency investment is subject to high market risk. Binance is not responsible for any of your trading losses. The statements made in this article are for educational purposes only and should not be considered financial advice or an investment recommendation.