TL;DR

Wrapped Ether (WETH) is a token pegged to Ether (ETH). WETH is used in several platforms and DApps that support ERC-20 tokens. While ETH is used to pay for network transaction fees, it doesn't have the same functionality as ERC-20 tokens.

You can easily convert ETH into WETH through a process known as wrapping. You can also convert WETH back into ETH at any time. Both wrapping and unwrapping follow a 1:1 ratio, meaning there are no extra costs apart from transaction fees.

You can wrap your ETH manually by interacting with the WETH smart contract, which will store your ETH and give you back the exact same amount of WETH.

Ethereum's DeFi ecosystem is large, and using WETH provides more opportunities for staking and investing. There are many versions of WETH, but some are more popular than others. You can even find wrapped ETH on other blockchains to use in their ecosystems. Popular uses for WETH include NFTs trading, providing liquidity to liquidity pools, and crypto lending.

Introduction

If you use Ethereum, most tokens you trade and invest with are likely to use the ERC-20 token standard. Using this technical standard has become a popular option for Decentralized Applications, wallets, and projects as it offers practicality to most users. However, this fact has presented a problem for Ethereum's native coin, Ether.

Ether doesn't follow the same rules as ERC-20 tokens, but there is a demand to use it in ERC-20 DApps too. Wrapped Ether is the solution to this problem, and you may have already come across it. Let's see why it's become a useful tool for investors and holders across so many projects and DApps.

What is wrapped Ether (WETH)?

WETH is an ERC-20 token on Ethereum pegged to the price of Ether (ETH). While Ethereum's native token, ETH, can be used to pay gas fees, WETH can't. However, WETH has a wider range of use cases than ETH and is very popular in the Decentralized Finance (DeFi) ecosystem. MetaMask, TrustWallet, and pretty much any wallet in the Ethereum network will support WETH. Let's explore some of its use cases.

Why do we need to wrap ETH?

At first, it might seem confusing why we have a token like WETH. Don't we already have ETH on the Ethereum blockchain anyway? The first thing to understand is that not every token on Ethereum is technically alike. The network allows developers to create new rules and standards for cryptocurrencies.

One example would be the ERC-721 format that gives us Non-Fungible Tokens (NFTs). These act very differently from Ether or ERC-20 tokens. Developers have a lot of room for customization when creating these digital assets. So while ETH can be used to pay for gas fees on Ethereum, ETH can't be used in every DApp.

Most DeFi DApps nowadays accept ERC-20 tokens for investment and staking opportunities. If we want to add ETH to a liquidity pool or use it as collateral, it's much easier to have it in an ERC-20 version. This provides the most compatibility across the blockchain and saves time developing new smart contracts.

How to wrap Ether (ETH)?

The process of generating WETH is simple - you send your ETH to a smart contract that then provides WETH in return. This means that all WETH created is backed up completely by ETH reserves. Your ETH is locked in the smart contract and can be exchanged back at any time for WETH. When your ETH is returned, the contract burns the supplied WETH.

To wrap Ether, you can interact directly with the WETH smart contract, so that it takes your ETH and credits your wallet with WETH at a 1:1 ratio (you still have to pay for transaction fees). Converting back requires another smart contract interaction, but the process is pretty much the same.

However, it's much easier to swap another token for WETH using a crypto exchange. Let’s see how you can swap your ETH for WETH using the Uniswap DEX or directly through your Metamask wallet.

Wrapping ETH on Uniswap

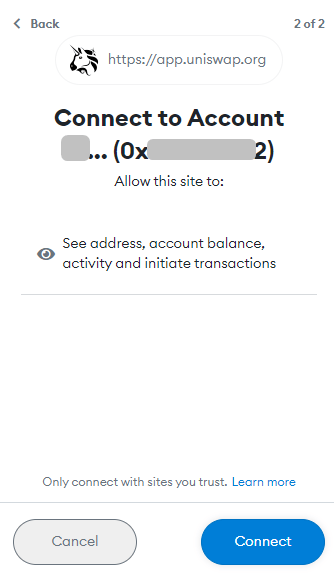

1. Open Uniswap and connect your wallet. Make sure Ethereum is also selected as your network.

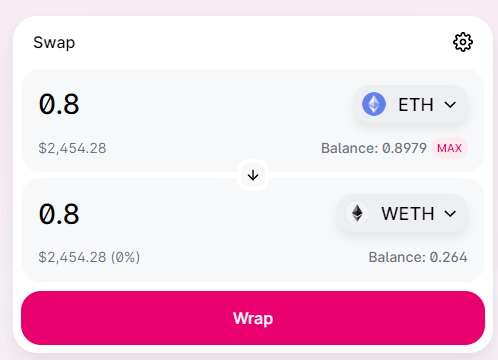

2. Select ETH in the top field and WETH in the bottom. If you click [Select a token], you should see WETH above the list.

3. Input the amount of ETH you want to convert to WETH and click the [Swap] button.

4. You’ll now need to confirm the transaction in your crypto wallet. Don’t forget that you’ll also need to pay gas fees, so make sure to have extra ETH at hand. Check the details of the transaction and click [Confirm].

5. Now you just need to wait for the transaction to be confirmed in the blockchain. The waiting time will depend on the current network traffic. If you are in a hurry, you can speed up the transaction (i.e., pay higher fees) to have it confirmed faster.

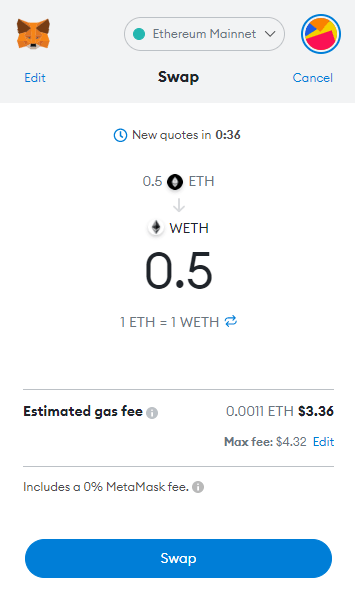

Wrapping ETH on MetaMask

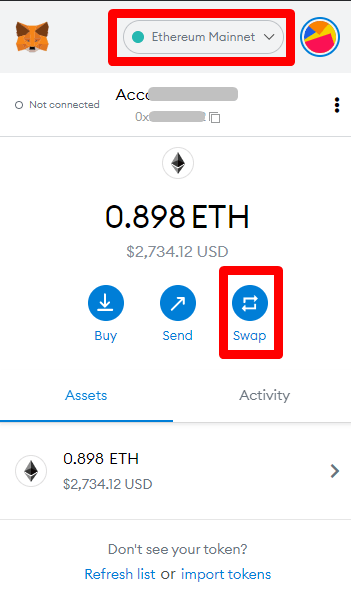

1. Open your MetaMask wallet and make sure your network is [Ethereum Mainnet]. Next, click [Swap].

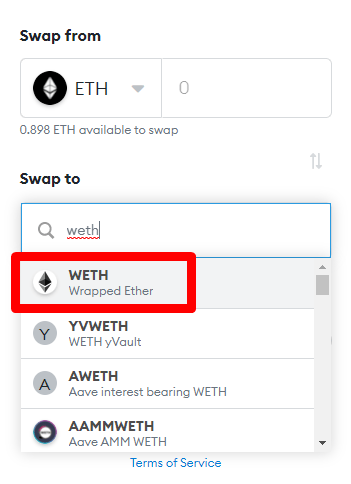

2. In the [Swap to] field, search for WETH.

3. Input the amount of ETH you want to swap and click [Review Swap].

4. You’ll now see a quote showing the conversion rate (which should be 1:1). Click [Swap] to finalize your transaction.

How to unwrap Ether (WETH)?

As mentioned before, you can unwrap Ether manually by interacting with a smart contract. However, it’s simpler and safer to swap WETH for ETH. To do this, follow our previous Uniswap or MetaMask instructions, but make sure you are changing from WETH to ETH. You can also use Binance to convert your WETH.

1. Head to the Binance Convert & OTC Portal. Select WETH in the [From] field and ETH in the [To] field, and then click [Preview Conversion].

2. You’ll now see the details of the trade. Make sure to confirm them before accepting the swap. Note that Binance does not allow you to swap ETH for WETH using this method.

Can you wrap ETH on other blockchains?

Other wrapped versions of ETH exist across major blockchains, which increases ETH’s interoperability. Using wrapped ETH on the BNB Smart Chain (BSC), for example, allows you to trade or use WETH within the BSC DeFi ecosystem. To do this, you'll need to withdraw ETH from Binance or another exchange into your BSC wallet. Make sure that your exchange supports the conversion from ETH to WETH before making the withdrawal.

Alternatively, you can use a bridging service. These are third-party DApps that take crypto and store it on the origin blockchain, and then mint wrapped tokens at a 1:1 ratio on the destination blockchain.

Bridging tokens often works fine, but note that moving tokens across blockchains may involve risks. There were cases where some bridges had their smart contracts compromised. If you want to bridge wrapped Bitcoin, wrapped Ethereum, or another token, carefully research the platform you use before using their bridging services.

How does wrapped ETH stay the same price as ETH?

The key to maintaining WETH's peg with ETH is its 1:1 convertibility. If WETH were cheaper, people would buy it and convert it to the more expensive ETH to make a profit. This opportunity would increase WETH's demand and, therefore, price. If WETH were more expensive, people would purchase ETH and convert it to WETH to sell, increasing WETH's supply and lowering its price. These principles of supply and demand ensure that the peg remains relatively stable.

Which DeFi apps can I use WETH with?

Ethereum has many DeFi DApps to explore that accept ERC-20 tokens. One option is to add WETH to a liquidity pool available on a Decentralized Exchange (DEX) like Uniswap. After providing liquidity, you'll begin to earn fees from users who swap their tokens using the pool. However, impermanent loss is always a possible risk that can lead to a decrease in the number of your deposited tokens. Using a pool with larger amounts of liquidity will reduce this risk.

You could also begin lending out your WETH on a platform like Aave. Other users can borrow your tokens but must first provide collateral covering their loan. In return, you'll receive interest until you decide to remove your deposit.

Conclusion

Ethereum has one of the oldest and most developed DApp ecosystems out there. This makes WETH a necessity, as many ETH holders want to use their ETH in DeFi projects. If you decide to start experimenting with WETH, we recommend buying it with ETH or other tokens, as it’s simpler and more convenient than interacting with the wrapping smart contracts.