TL;DR

Reef is a layer 1 blockchain built using Parity’s Substrate technology. Launched in 2019 by Denko Mancheski, it's undergone a significant transformation from a DeFi platform to a fully-functioning blockchain.

The network uses Nominated Proof of Stake (NPoS) to process valid blocks of transactions. Nominators stake REEF behind validators with hopes of being selected into the active validator set. When a validator successfully processes a block, a reward is shared between them and 64 nominators.

For network upgrades, a Technical Council nominated via a Proof of Commitment (PoC) consensus mechanism proposes changes.

The blockchain's native cryptocurrency, REEF, is used to take part in governance and pay network transaction fees. You can purchase REEF on Binance with a debit/credit card or by trading for it with other cryptocurrencies.

Introduction

Reef is a Substrate-based, layer 1 blockchain founded in 2019 by Denko Mancheski. In November 2021, the project rebranded from Reef Finance to reflect its development from a Decentralized Finance (DeFi) platform to a fully functioning blockchain.

Like other networks, Reef offers use cases for NFTs, DeFi, smart contract development, and GameFi. Reef also provides liquidity bridges to move ERC-20 tokens between Reef and Ethereum, and BEP-20 tokens between Reef and the BNB Chain.

The Reef blockchain

How Reef governance works

Reef, however, allows two groups to work together in implementing changes to the network: a Technical Council and Validators.

The Technical Council

The Technical Council approves and reviews network updates. These members are elected via the PoC consensus mechanism. PoC has similarities with Delegated Proof of Stake but incorporates a long bonding period of at least a year. Anyone, therefore, who stakes Reef to nominate a Technical Council member is incentivized to vote for competent members with longevity.

Technical Council members make decisions on block size, block time, throughput, and other technical parameters. Making these changes on-chain is possible through a majority approval from the Technical Council.

Validators

Validators process blocks of legitimate transactions and run a node. These are elected using the NPoS consensus mechanism. As previously mentioned, all transaction fees are burned on the Reef. This means that validators are paid rewards from a yearly inflation pool (set roughly at 8%).

Validators are selected by nominators, which we'll discuss shortly. If a validator acts maliciously or misbehaves, they will have their stake slashed.

Staking on Reef

Both validators and nominators in NPoS must stake REEF to take part. By staking REEF, nominators earn more REEF by picking good validator candidates. If the validator is elected into the active set and successfully processes blocks, the nominator can share their rewards. If the validator misbehaves, the nominator will lose some of their stake, and the validator will be slashed.

Staked REEF is locked until the nominator decides to remove their validator nomination, which becomes effective in the next era (roughly 24 hours). The nominator must then wait 28 days for their stake to be returned.

Active validator set and rewards

Not every nominated validator will make it into the active set of validators. In most cases, an algorithm will only allow you to actively support one successful validator per era. This is the case even if you staked behind multiple ones chosen for the active set.

Each validator can only support payouts to 64 nominators. If a validator has more nominators than this, they are oversubscribed. Only the top 64 nominators by the amount staked will receive rewards.

Even if they don't receive rewards, the other nominators' stakes will still count towards the total staked behind a validator. The set of validators is computed off-chain, with some nominators eliminated according to the size of their stake.

The Reef ecosystem

Reef isn’t only made up of its blockchain. It has an ecosystem of tools and services that complement its layer 1 network.

Reef Web Wallet

ReefScan

ReefSwap

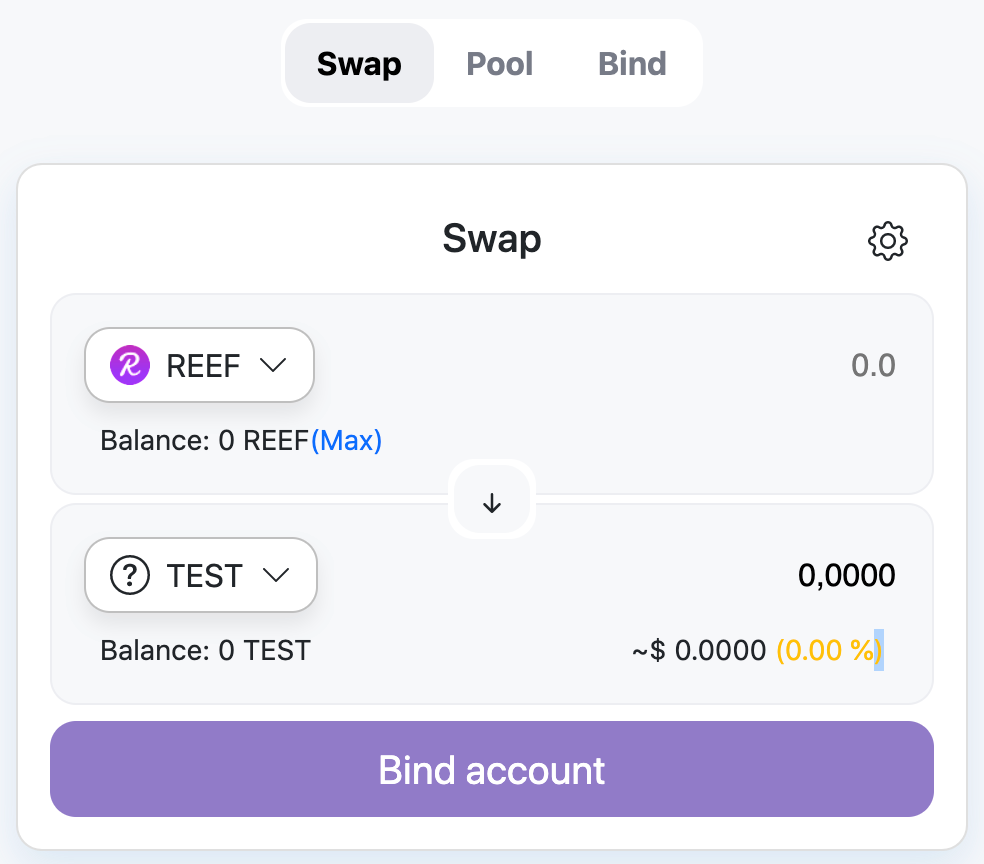

ReefSwap is a DEX offering a swapping service for Reef tokens. It uses the familiar Uniswap V2 model and requires users to access it via the Reef browser extension. This is due to Reef being Substrate-based. Users can also claim an EVM wallet address and assign it to their Reef Account.

What is REEF?

The REEF token is Reef's native cryptocurrency. It can be used to pay transaction fees on the network using its gas system and in on-chain governance. This includes both the NPoS and PoC consensus mechanisms.

Where can I buy REEF?

Click [Continue] to confirm your purchase and follow the instructions given.

Conclusion

For many, Reef is still well-known for its original DeFi business model. However, Reef has made significant development changes and has grown into a more developed ecosystem and fully functioning blockchain. The blockchain’s new developments are still young, giving it great potential for growth in the number of smart contracts and Decentralized Applications (DApps) that can be deployed on the network.