TL;DR

Ankr is a decentralized Web3 infrastructure provider that helps developers, decentralized applications, and stakers interact easily with an array of blockchains. You can access APIs and RPCs to build DApps easily, stake on Ankr Earn, and get custom solutions for blockchain enterprise needs.

The project’s token, ANKR, facilitates all activity on Ankr Protocol. It is used to pay for requests to blockchains, reward independent node providers for serving requests, and reward ANKR holders for staking their ANKR to full nodes. You can purchase ANKR on Binance with a credit or debit card on the exchange.

Introduction

Cross-chain and multi-chain opportunities have become hugely popular with investors and users. Previously complicated cross-chain activity is now much easier with a developing Web3 ecosystem. Ankr is a large part of this movement and is made for users looking for a streamlined method of interacting with multiple blockchains. Whether you're a developer or crypto investor, Ankr has something to offer.

What is Ankr?

Ankr was founded in 2017 by Chandler Song and Ryan Fang, with a mainnet launch in 2019. It offers a suite of Web3 (AKA Web 3.0) tools that help developers, applications, and stakers access multiple blockchains' infrastructure through one decentralized platform. Anyone can provide a node to the Ankr Protocol and earn rewards for serving requests to blockchains from all over the world. On the other hand, developers and projects who don’t want to set up and run their own nodes can pay to utilize the decentralized node infrastructure available on Ankr Protocol. Users who want to stake or become validators across various blockchains can also use Ankr to easily manage the process.

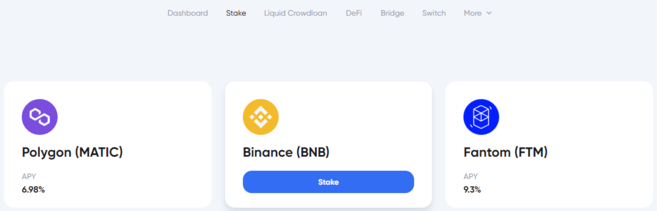

Ankr currently supports staking on Polygon (MATIC), Ethereum (ETH), BNB Smart Chain (BNB), Avalanche (AVAX), Polkadot (DOT), and Kusama (KSM). You can also use ANKR to run Ethereum 2.0 nodes by paying a monthly fee for a simplified validator experience.

How does Ankr work?

It's important to understand that Ankr is not a blockchain. It operates as a suite of tools for builders, stakers, and enterprises. Its main features include:

Decentralized node infrastructure services

Ankr’s decentralized infrastructure benefits DeFi platforms, NFT projects, blockchain games, and DApps of all kinds. Having so many high-performance independent nodes all around the world serving requests means all of these applications can receive faster, more scalable, and more affordable access to blockchains.

Setting up a blockchain node requires technical knowledge, time, and effort. Not everyone has the skills to manage node deployment themselves. If you need a dedicated node, Ankr can launch one for you to access remotely. Ankr Protocol is comprised of independently run nodes all around the world that you can request data from at any time.

Premium API and RPC endpoints for developers

Developers deploying smart contracts and DApps to a blockchain need to work with specific APIs (Application Programming Interfaces). However, this typically requires running your own node and spending hours synchronizing it to the blockchain's current state. Ankr Protocol removes the need to run your own nodes entirely by providing instant API services and RPC access via their network of decentralized node providers.

Having dedicated Application Programming Interfaces (APIs) and Remote Procedure Calls (RPCs) means that you and your project can interact with blockchains without competing traffic from other users on shared servers. By using an API endpoint at Ankr, you'll have access to the whole chain's data without doing the setup work yourself. The API will supply your DApp with all the information it needs to run successfully and give a better user experience.

Liquid staking

A common DeFi (Decentralized Finance) issue is losing liquidity when you stake funds. In addition to offering staking across multiple chains, Ankr also provides reward-earning tokens that represent your staked funds. You can then use these new “liquid staking tokens” to trade or use in DeFi for additional earning strategies like liquidity mining, yield farming, lending, and more. This mechanism helps unlock the value of your staked investments to earn in more places.

To begin with staking, you'll need to connect your wallet to the platform. Because you can stake multiple cryptocurrencies through Ankr, the platform supports a range of wallets. Let's look at staking ETH as an example. Once you have gone through the staking process (which we go through later in this guide), you'll receive reward-earning aETHb, or reward-bearing aETHc tokens in return. As your ETH is locked in preparation for Ethereum 2.0, aETHb and aETHc provide a liquid way to access the value of your staked assets.

Enterprise

Ankr offers a Web3 Infrastructure-as-a-Service model for businesses that require flexible, custom-made solutions. Organizations dealing with multiple blockchain networks can use Ankr's API and RPC services accessible through a monitoring platform. As business needs usually differ from those of smaller projects, DApps, and users, this enterprise solution caters more specifically to business use cases.

What is ANKR?

ANKR is the Ankr platform's utility token. ANKR is an ERC-20 and BEP-20 token that can be used in both the Ethereum and BNB Smart Chain ecosystems. The ANKR token has a max supply of 10,000,000,000 and plays a core function in Ankr Protocol’s decentralized infrastructure marketplace:

1. Ankr Protocol users pay for Premium services with ANKR.

2. Independent node providers stake ANKR and serve traffic to earn ANKR rewards.

3. Token holders can stake ANKR to help secure the protocol and share in the rewards.

4. Pay ANKR for remote access to your own Ankr-run node.

5. Use ANKR to vote with Ankr's governance mechanism.

As such, ANKR can be used both as a utility token and a governance token within the Ankr network. ANKR is a payment method for all Ankr products and a crucial part of the Ankr Protocol for users, providers, and stakers. This makes ANKR more similar to PancakeSwap's CAKE than native cryptocurrencies with their own network like BTC or ETH.

Where can I buy ANKR?

You can easily purchase ANKR on Binance with two methods. Firstly, you can purchase the token with a credit or debit card using selected fiat currencies. Simply visit the [Buy Crypto with Debit/Credit Card] page, select your desired fiat currency to pay, and then choose ANKR in the [Receive] field. Click [Continue] for further instructions and confirmation of your purchase.

ANKR can also be traded with a selection of other cryptocurrencies. Head to the Exchange view and type ANKR in the trading pair search field to find a list of available trading pairs.

How do I stake using Ankr?

1. One of Ankr's key features is an easy way to stake across multiple chains in one client. To do this, first head to the Ankr Earn website and select the crypto you want to stake. Here, we've chosen BNB, so we need to click [Stake]. Note that BNB staking on the Binance Beacon Chain requires you to use the Binance Chain Wallet.

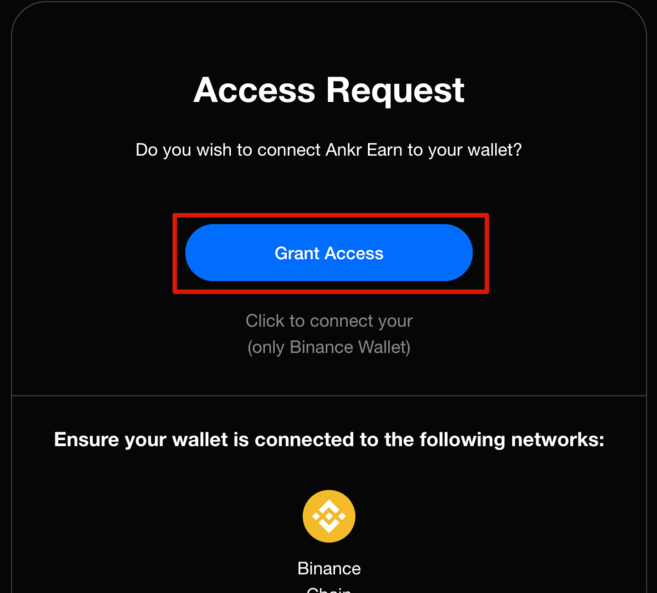

2. Now, click the large [Grant Access] button.

3. Select your account.

4. You'll now be able to choose the amount you want to stake. Make sure to have BNB to pay your transaction fees, and remember to return to Ankr if you want to unstake your funds.

Closing thoughts

No matter what kind of blockchain user you are, there will likely be an Ankr service you're interested in. Users can stake with different blockchains in a suite that can manage all funds in one place. Builders can access decentralized multi-chain development tools with the ability to expand quickly onto other networks. And enterprises can get any custom solutions they need to integrate staking products, infrastructure, and more with their platforms. So far, Ankr has positioned itself among the fastest growing providers of decentralized infrastructure, and it continues to add more services for Web3 developers and users.